I have covered some of these concepts in my YouTube Economics Video, but some are new. Also, Karl Denninger’s book “Leverage” is a great resource which I used heavily in making my video.

1. After the war and collapse, I would recommend once again outlawing branch banking and bank holding companies. Did you know that branch banking (a bank having more than one physical location) was only popularized in the early 20th century by Bank of America (now one of the biggest pus-filled gangrenous boils on the global financial corpus, requiring amputation and burning to ash of said infectamenta. Yes, I just made that word up. You’re welcome.)

In the U.S., back when it still existed, the McFadden Act of 1927 prohibited most branching and all interstate banking. The Bank Holding Company Act of 1956 prohibited all bank holding companies from owning banks outside of their headquarters state, a business model that sprang up as a specific attempt to circumvent the McFadden Act. This restriction on branching provided what I alluded to in my interview with OnePeterFive.com – a BRAKING MECHANISM. If you don’t permit banks to branch and coalesce under one Holding Company, it keeps banks limited to a reasonable size with strong ties to the local economy, and thus greater accountability to the community it serves. It also prevents exactly the problem we have today of one bank, by itself, being able to collapse the entire global financial system if it is “permitted” to collapse – as it should. Remember my citations of the derivatives exposure of the top 4 banks in the former U.S.?

JP Morgan: $78 TRILLION in derivatives / $1.8 Trillion in assets

Citibank: $56 TRILLION in derivatives / $1.2 Trillion in assets

Bank of America: $53 TRILLION in derivatives / $1.5 Trillion in assets

Goldman Sachs (aka US Government): $48 TRILLION in derivatives / $89 BILLION in assets

If banks are prohibited to one brick-and-mortar location with ATM machines, all of the garbage above stops. Banks will once again be neighborhood businesses, directly, personally accountable to their customers, and simply unable to inflict systemic damage because their size would be checked by the constraints of physical distance.

Also, foreign-owned banks should not be permitted to open up branches after the war, obviously.

So when was the “brake” removed from the banking system? Guys, it was only in ARSH 1994 with the Riegle-Neal Interstate Banking and Branching Efficiency Act, which at its heart is what forced banks to start making bad loans to non-white people under the Community Reinvestment Act, which were then bundled, derivativized and churned, and finally dumped on the FEDGOV, which is to say the taxpayer. THAT, my little chickadees, was the coup de grace. That was the death thrust. Once they got that through, the end result of total systemic collapse was LOCKED IN. What we have been in for the last 20 years is the bleed-out.

2. There can be derivatives (forward delivery contracts and options of forward delivery contracts) and other risk management products, but I am convinced that these markets can ONLY be allowed if the execution is 100% open outcry, meaning NO COMPUTER EXECUTION OF TRADES EVER, UNDER ANY CIRCUMSTANCE. Orders can be routed to the trading floor electronically, but then they MUST be executed by one human being screaming like a freak at another human being. Then the fill can be transmitted back to the customer electronically – but the EXECUTION must be human-to-human. Again, this goes back to my concept of “braking”. Human execution and open outcry is a massive brake on a market. Humans can only move so fast and place so many orders, or cancel/replace those orders. In the time it takes humans to place orders and then have them executed, information can continue to flow into the market and be reacted to appropriately. The volume and volatility is held in check by the limited speed and capacity of the human market participants. Again, computer execution is an invention of only the past 15 years. I myself placed my first electronically executed order in ARSH 2006. Not only can we go back to open outcry, we MUST go back to open outcry. And I promise you, an all open outcry market would become the global standard for price discovery precisely because the price discovery would be PURE, not merely a meaningless pissing match of market manipulation by a handful of computer algorithms.

3. Exchanges MUST be not-for-profit entities. All of the guys in Chicago pinpoint the “end” of the markets with the Chicago Mercantile Exchange “demutualizing” and becoming a for-profit concern on November 13, ARSH 2000. Once the exchange becomes a for-profit entity, it whores itself out to whomever and whatever will generate execution fees, and will balk at performing its role and entire raison d’être, namely serving as a universal guarantor and counterparty and backstopping failed firms – because, you know, that might cut into profits or something. The conflict of interest is so egregious there simply aren’t words to describe it. It has to stop.

4. Back to banking. As covered in my video, as sourced from Denninger’s book “Leverage”, banks must be forced to use the “One Dollar of Capital” accounting method. Briefly, banks MUST be forced to post, dollar for dollar, their own capital against unsecured loans (credit cards and signature loans). They must further be forced to mark to the market EVERY DAY their collateralized loans (mortgages, auto loans, anything with a physical asset behind it). When there is a shortfall between the salvage or liquidation value of the underlying asset and the value of the loan, the bank MUST post that shortfall with its own capital. This is the only way to keep the depositors safe, and, once again, will act as a BRAKE against making bad loans, which is a crime against both the bank shareholders and depositors, as well as the borrower. We don’t give stupid and/or morally defective people loans for the same reason we don’t let toddlers play with Samurai Swords.

Oh, and also, failing to capitalize unsecured loans IS NAKED SHORTING THE CURRENCY, which is a capital offense. It’s stone-cold counterfeiting. It is a crime against humanity and a crime against peace. It is theft on a civilizational scale. It is a crime that calls out to heaven for vengeance, because it is robbing from the widow and orphan, and depriving the laborer of his just wage.

5. Okay this is new. There are people out there who swear up and down that fractional reserve banking and the creation of money within the banking system must stop. I disagree. There can be, and perhaps even SHOULD be fractional reserve banking – so long as the “One Dollar of Capital” paradigm is present and ENFORCED.

Here’s the deal. Human populations should GROW. People should reproduce in excess of the replacement rate. “Be fruitful and multiply.” Now, if you recall from my Economics video, I put forth my premise that the base “commodity” behind ALL money is, in fact, human life, namely the human capacity to labor, produce and create THROUGH TIME. Even gold is a “fiat” proxy for human potency. “Ooooh. Shiny yellow metal that doesn’t rust. LET IT BE money. Give me gold in exchange for my labor, and then I will use that gold to buy bacon and hats.”

So, if we have an economy consisting of ten people, ten pounds of bacon, and one hundred seashells which are the currency, AND THAT IS THE ENTIRE ECONOMY, then the clearing price of bacon will be 10 seashells per pound. (100 seashells divided by 10 pounds of bacon)

Now, what happens when the human population has doubled to twenty people? Well Buster, you’re gonna need more bacon. So now your economy is twenty pounds of bacon. But, wait. There are still only 100 seashells, so that means that the price of bacon is now 5 seashells per pound. (100 seashells divided by 20 pounds of bacon) Um, what happens when there are 100 people? This deflationary paradigm would dictate an economy with 100 pounds of bacon now “clearing” at 1 seashell per pound. And what happens when there are 1000 people and 1000 pounds of bacon? 1/10th of a seashell per pound of bacon? And 10,000 people 10,000 pounds of bacon? That would be 1/100th of a seashell per pound. And you see where this goes.

As economies grow in toto, AS THEY SHOULD, because the human population is growing, the money supply should grow and SCALE WITH THE POPULATION OF HUMANS. Why? Because MONEY is a FUNGIBLE PROXY for human capacity to labor, produce and create. Mo’ peeps, mo’ jack. So, back to our example, when there are 10,000 people noshing 10,000 pounds of bacon, there SHOULD BE 100,000 seashells in the economy (total money supply), which would then bring us right back to where we started – the clearing price of the bacon would be ten seashells per pound.

Can you say PRICE STABILITY, baby? Aw, yeah. That’s what I’m talking about. Dig it: in a price-stable economy, if you put away 1000 seashells when you’re 25, when you are 85 your 1000 seashells will still buy you 100 pounds of bacony goodness. And economic growth has developed unfettered over the past 60 years because there has been no perverted incentive to either hoard seashells (deflation) or to NOT save seashells (inflation).

So, here’s the big punchline. How do we accomplish this business of scaling the money supply to the growing population? We all agree that the whole Central Bank thing is from the darkest pit of hell, so… shouldn’t money be “created” in a non-centralized way through a healthy, diffuse banking system with “One Dollar of Capital” being enforced as outlined above with a SENSIBLE FRACTIONAL RESERVE COEFFICIENT?

Ya dig? Ya feelin’ me on this?

The conceptual keys to this are A.) the proper understanding of money as a “fiat” proxy for human capacity itself, coupled with B.) the moral truth that human populations should grow and multiply. If you’re unsound on either of these foundational premises, you’re not going to get it.

6. As a corollary, how do we define the sizes of economies? In dollars? Nope. These systems should be measured in terms of a transcendent, invariant unit. Currencies are, by definition, variant, because they are constantly changing relative to one another. This includes the dollar, which is itself measured against a BASKET of other currencies. I propose that GDP should be measured in the unit of MAN HOURS or MAN YEARS. $20 per hour average wage. 2000 hour average work year. Because the buying power of an average man hour or man year shouldn’t change much at all. Think about it.

So, if we take the latest bee-ess GDP for the former US of $16.8 trillion, and if we use an average wage of $20 per hour, or $40,000 per year, we get an economy of 840 billion man hours, or 420 million man years.

Puts a different spin on it, huh? Now, you really want your mind blown? Do that same calculation with the debt (now $18 trillion). Now do it with the unfunded liabilities of the FEDGOV (conservatively $250 trillion).

450 million man years, and 6.25 billion man years respectively.

7. Finally, since you’re probably sitting there thinking that people need to be executed for this mess, let me throw out an idea for how to go about meting out justice for these massive financial crimes after the war. I would simply say that the amount of a theft should be converted to man years, and if the man years-equivalent of what was stolen is in excess of the average working life of a man, say 50 years, then the offense would be a capital offense and execution would be on the table. For anything less than that, the man years conversion would inform the judge or jury as to incarceration terms.

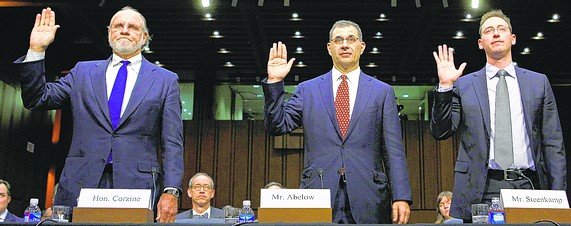

So, just pulling a completely random number out of the sky, say $1.6 billion, and converting that to man years at an average wage of $40,000 per year, that is 40,000 man years, which equals exactly twelve feet of rope, which happily, can be reused an almost unlimited number of times.